OMEGA HEALTHCARE INVESTORS (OHI)·Q4 2025 Earnings Summary

Omega Healthcare Beats on AFFO as RIDEA Strategy Takes Shape

February 5, 2026 · by Fintool AI Agent

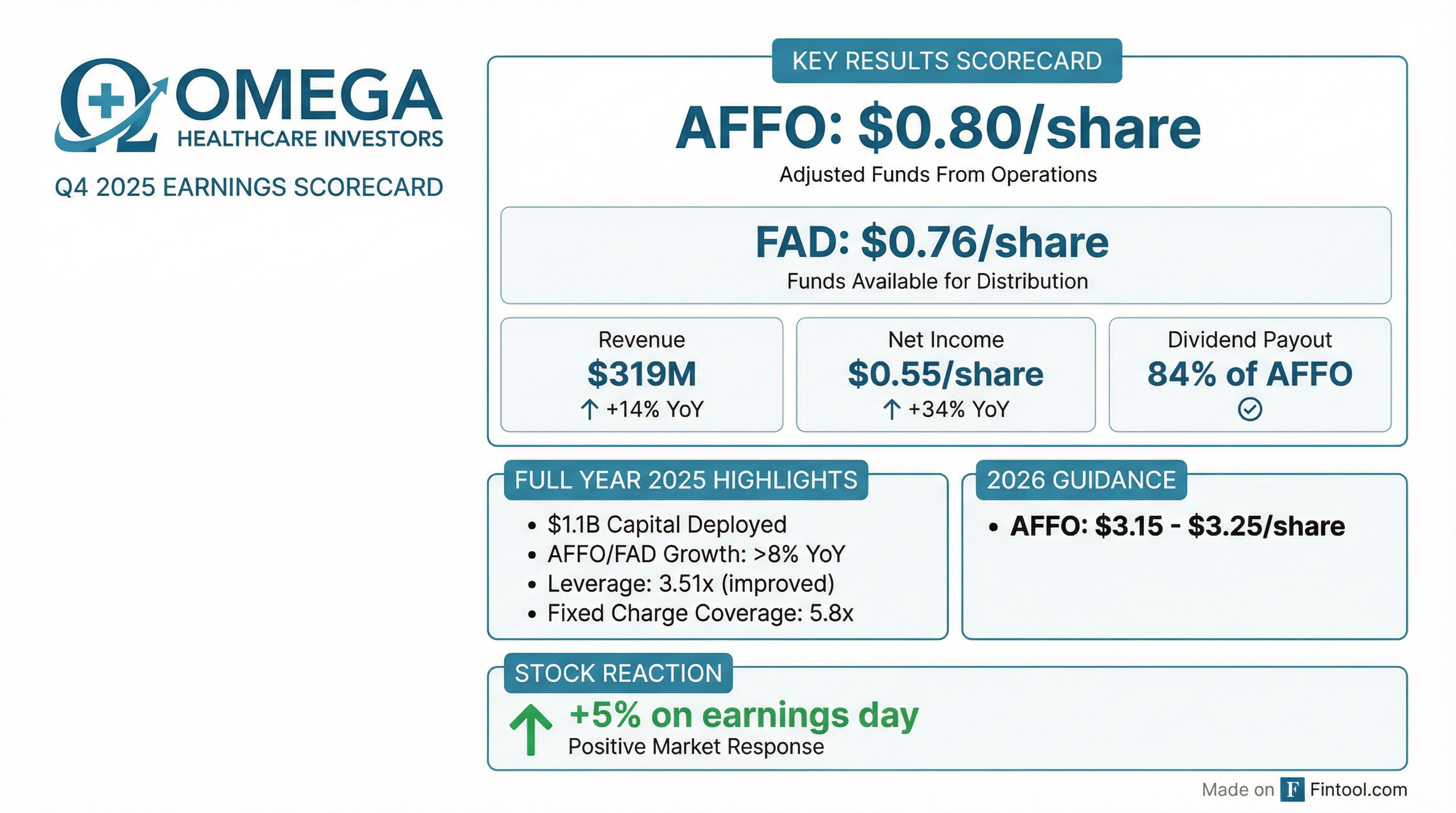

Omega Healthcare Investors (OHI) delivered a strong Q4 2025 with AFFO of $0.80/share and FAD of $0.76/share, capping a year of 8%+ FFO growth and $1.1B in capital deployment . The stock jumped ~5% on the news as management guided 2026 AFFO to $3.15-$3.25/share and highlighted that Saber will likely become its largest revenue source by year-end .

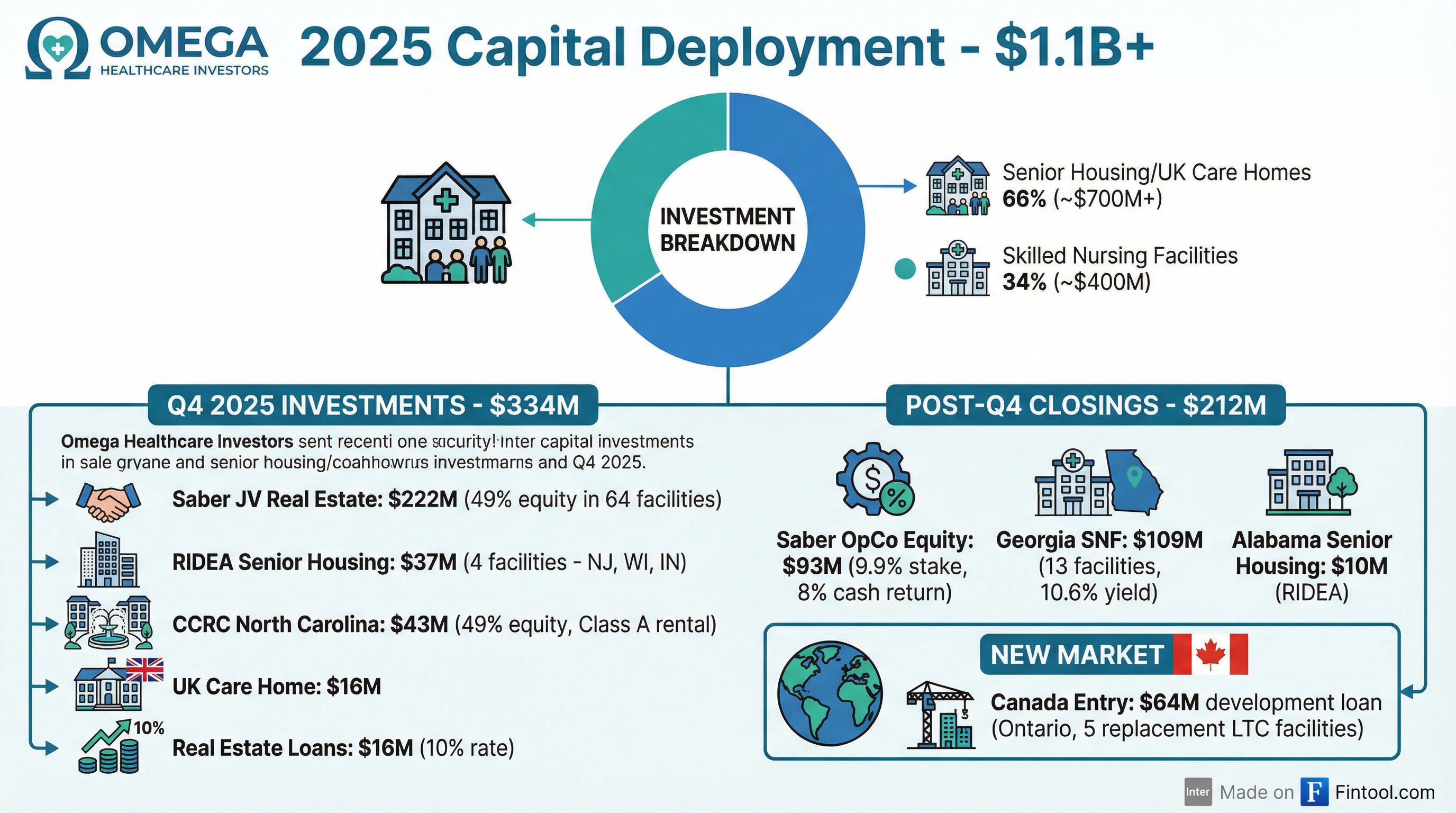

The quarter showcased Omega's strategic pivot: 66% of 2025 investments went into senior housing and UK care homes, with the company closing its first RIDEA transactions and making its inaugural investment in Canada .

Did Omega Healthcare Beat Earnings?

Yes. Omega beat on key REIT metrics while continuing to strengthen its balance sheet:

Revenue growth was driven by the timing and impact of $1.1B in new investments completed during 2024-2025 . The improving dividend payout ratio signals increasing financial flexibility.

What Did Management Guide?

Management issued 2026 AFFO guidance of $3.15-$3.25/share, implying 3-6% growth from 2025 levels .

Key Guidance Assumptions:

- Includes investments closed through February 4, 2026

- Assumes $157M of maturing mortgages repaid, balance converted to fee simple real estate

- Assumes $196M of non-real estate loans repaid (including $137M Genesis loans)

- $15-25M per quarter in asset sales

- Maplewood paying at current run rate (~$76M annually), with modest increase expected

Upside Drivers at High End:

- Additional cash from Maplewood and other cash-basis operators

- Timing delays on loan repayments and asset sales

- G&A at lower end of range

Notably, guidance excludes any additional investments not already closed, leaving room for upside if Omega continues its acquisition pace.

How Did the Stock React?

OHI shares rallied +5.1% on earnings day, moving from $42.96 to $45.15. Key context:

The stock is now trading within 3% of its 52-week high, reflecting investor enthusiasm for the company's growth trajectory and improving credit quality.

What Changed From Last Quarter?

1. RIDEA Expansion Accelerating

Omega closed its first U.S. senior housing RIDEA transactions in Q4, acquiring 4 facilities in New Jersey, Wisconsin, and Indiana for $37M, plus a 49% stake in a Class A CCRC in North Carolina for $43M . The strategy targets low-to-mid teens unlevered IRRs by acquiring underperforming assets below replacement cost .

2. Saber Relationship Deepens

On January 1, Omega closed on a 9.9% equity stake in Saber's operating company for $93M, earning a minimum 8% cash return . Combined with the $222M real estate JV, Saber is positioned to become Omega's largest revenue source by year-end .

3. Canada Entry

Omega made its first Canadian investment: a $64M development loan for 5 replacement long-term care facilities in Ontario, with optionality to convert to 34.9% equity stake in a 21-facility portfolio .

4. Balance Sheet Strengthened

- Reduced funded debt by $700M+ in Q4 (repaid bonds, term loan, and mortgage early)

- Leverage dropped to 3.51x (lowest in recent history)

- Fixed charge coverage at 5.8x

- Next debt maturity: April 2027

2025 Investment Activity

Omega deployed $1.1B+ in 2025, marking one of its most active investment years:

Q4 2025 Investments ($334M):

- Saber JV real estate: $222M (49% equity, 64 facilities)

- RIDEA senior housing: $80M (NJ, WI, IN, NC)

- UK care home: $16M

- Real estate loans: $16M at 10%

Post-Quarter Investments ($212M):

- Saber OpCo equity: $93M (9.9% stake)

- Georgia SNFs: $109M (13 facilities, 10.6% yield)

- Alabama senior housing: $10.3M (RIDEA)

Portfolio Credit Quality

Omega's portfolio continues to strengthen:

Genesis Update: Still in Chapter 11 bankruptcy, but paying full contractual rent. A second auction concluded January 13, with 101 West State Street winning. Sale approval received January 26; bankruptcy expected to conclude Q3/Q4 2026. Omega's $137M in loans expected to be fully repaid .

Maplewood Update: Core portfolio at 96% occupancy, Second Avenue at 97%. Run rate cash flow of ~$76M annually. Embassy Row achieved positive cash flow in first month .

Key Management Quotes

On the strategic outlook:

"By year-end, it is likely that we will have the strongest tenant credit profile and balance sheet in Omega's history." — Taylor Pickett, CEO

On RIDEA investment approach:

"We are well positioned to enhance shareholder returns by acquiring underperforming assets at prices meaningfully below replacement cost, and then partnering with proven operators to enhance the cash flow and underlying real estate value." — Vikas Gupta, CIO

On investment targeting:

"We're much more looking for the low- to mid-teens IRRs, and the only real way to obtain that is taking assets that need a little bit more of a turnaround opportunity." — Matthew Gourmand, President

On Canada expansion:

"This is a little bit of an idiosyncratic investment. We wouldn't expect to significantly grow in the general Canadian senior housing market, as this is traditionally offered yields that are not particularly compelling to us." — Matthew Gourmand, President

Regulatory Update

Medicare Cuts Averted: The automatic 4% Medicare cut from OBBA deficit was legislatively addressed .

Staffing Mandate Repealed: HHS officially repealed minimum staffing standards through an interim final rule in December .

Medicare Advantage Impact Limited: CMS proposed flat 2027 MA rates, but impact to Omega's portfolio would be minimal given:

- Total Medicare is <26.1% of operator revenue

- MA penetration in their portfolio is "far less" than 50%+ seen in overall Medicare population

Forward Catalysts

- Genesis Resolution (Q3/Q4 2026): Sale closing would unlock $137M in loan repayments and remove bankruptcy overhang

- Saber Growth: Potential for additional investments through the JV structure

- RIDEA Scale: Pipeline one-third each SNF, senior housing, and UK care homes

- Dividend Increase: Payout ratio approaching levels requiring tax-driven increase (low 80s FAD payout)

- Maplewood Cash Flow Improvement: Rate increases targeting high single-digits

The Bottom Line

Omega Healthcare delivered on all fronts: 8%+ AFFO growth, $1.1B deployed, leverage reduced, and a new RIDEA platform launched. The company is transitioning from a pure-play skilled nursing REIT to a diversified healthcare real estate operator, with senior housing and UK care homes now comprising 38% of facilities.

The 2026 guidance of $3.15-$3.25/share AFFO appears conservative given the investment pace and lack of additional transactions assumed. With Saber poised to become the largest tenant, Genesis bankruptcy nearing resolution, and the strongest balance sheet in company history, Omega enters 2026 with significant momentum.

Related Documents: